Something interesting happened in the stock market last week called ROTATION.

We saw the stock market pull back from it’s high, as investors started to wonder if maybe the peak in the market is in. Unemployment is now the lowest it’s been since 1969 which is great, but interest rates are now starting to move higher and that’s a concern for the stock market.

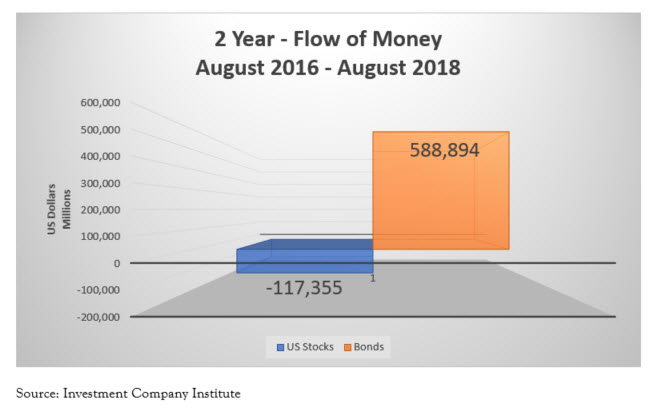

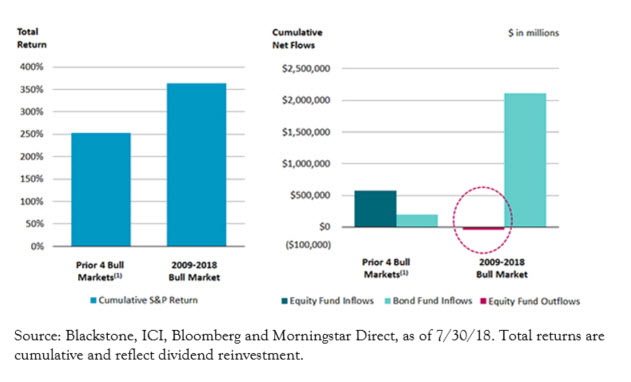

Over the last 9 years there has been no money added to stocks and $2.2 trillion added to bonds. You’re probably asking how can that be? that’s a logical question, and the simple answer is investors have pulled money out of well diversified mutual funds and added them to index funds which are much more concentrated in a small number of companies – in particular the ones that were being sold this week.

I know that’s a lot of numbers but what you need to know is that stock markets don’t suffer cataclysmic crashes when nobody is adding money to stocks. We may see some bumps up and down like this week as investors try to decide if they want to be in the stock market or out but I don’t think anything terrible is ahead of us.

Even with the market bouncing about, I am confident in your investments and you can be confident that we have our eye on your money. Let us know if you have any questions about your investments.

Last, as I always say, if you are bothered by what you see on TV, turn it off! Advertisers love it when there is bad news because they can run a 20- minute loop over and over and rack up the advertising dollars.

Call us at 678-894-0696 or email your questions to us at david.cross@us-am.com

David.Cross@us-am.com